Event data shouldn’t just tell you what happened, it should tell you who will be at an event, which accounts matter, and who your sales team should meet to create pipeline.

For B2B event marketers, event data is not about page views or form drop-offs. It’s about attendee intelligence:

- Which ICP prospects are attending

- Which accounts are sending executives

- Which sponsors and exhibitors are showing up

- What events your competitors are investing in

- Which companies match your buyer profile

This is the foundation of event-led growth, choosing the right events and pre-booking meetings with the buyers who can move revenue forward.

This article breaks down how B2B teams use attendee data to:

- choose the right events

- identify ICP attendees early

- personalize outreach

- book meetings before the event even begins

- and attribute pipeline back to events inside your CRM

If you want to turn raw attendee signals into meetings, pipeline, and revenue, this is the playbook.

Key Takeaways

- Treat event data as the fuel for meetings, pipeline, and revenue, not as vanity metrics. Focus on confirmed and predicted attendee data.

- Build an event data strategy that shows you who will be at each event, which accounts matter most, and where to prioritize spend.

- Use a strong data structure, event schema, entity matching, and centralized attendee intelligence to power precise targeting.

- Run analytics to understand which events produce the highest-quality ICP presence, not just the highest registration numbers.

- Track KPIs that prove event success across multiple events and tie them back to pipeline and revenue for budget justification.

- Connect Vendelux to Salesforce or HubSpot to push attendee lists, track meetings, and attribute revenue to event-sourced and event-touched deals.

Why Event Intelligence Matters

Traditional “event data” (website interactions, mobile app clicks, session scans) tells you very little about pipeline potential.

Vendelux defines event data differently:

Event data = real attendees + real companies + real buying roles.

This includes:

- confirmed attendee lists from organizers

- predicted attendance from historical patterns

- sponsor lists

- exhibitor lists

- account-level presence

- titles, seniority, buying committees

- overlap with your ICP filters

That’s audience intelligence, and it’s the foundation for event-led growth.

82% of top-performing B2B marketers say their success comes from understanding their audience.

With Vendelux, you stop guessing. You know which events your ICPs attend, who to target, and when to start outreach so you arrive with a calendar full of booked meetings.

Collecting Event Data: Build The Foundation

You don’t need session analytics. You need attendee intelligence that shows you:

What to Track

The data points that matter for pipeline:

- Confirmed attendee lists

- Predicted attendance (based on historical event patterns)

- Sponsors and exhibitors

- ICP presence by job title, role, seniority

- Target accounts and existing customers attending

- Competitors and category peers

- Net-new accounts that match your ICP filters

Why Timing Matters

The earlier you know who’s attending, the earlier you can begin outreach, and outreach before the event produces the highest meeting acceptance rate.

92% of marketers say event software makes it easier to achieve business outcomes.

How Vendelux Helps

- Matches attendees to your CRM accounts.

- Builds segments by persona, ICP fit, and buying role.

- Pushes attendees into automated, on-brand outreach that books meetings before the event begins (with humans in the loop).

Structuring Event Data: Add Context That Scales

Entity Data

- Person → name, title, seniority

- Account → company, size, industry, revenue

- Role → buyer, influencer, user, champion

- Region → US, EMEA, APAC

Event-Level Properties

- Event name, format, location

- Event dates

- Historical attendance

- Sponsor list

- Account match rate

- ICP concentration

- Predicted attendance

- Net-new opportunity potential

Why Structure Matters

A clean event schema creates a single source of truth across marketing, sales, RevOps, and leadership. It eliminates guesswork and aligns the entire GTM team around:

- Which events to attend

- Which accounts to target

- How much pipeline to expect

- How to budget

Analyzing Event Data: Turn Numbers Into Audience Insights

Once your attendee data is structured, your questions shift from “what happened?” to:

High-Impact Questions

- Which events have the highest concentration of ICP prospects?

- Which events historically produce meetings that convert?

- Which sponsors overlap with target accounts?

- Which events have high-value accounts attending at the same time?

- Which titles are hardest to book meetings with?

- Where is our competitive category investing?

Methods Used

- ICP match rate

- Historical conversion data

- Cohort analysis across events

- Segment analysis (persona, industry, company size)

- Meeting rate trends

- Multi-event attribution

Outcome

Decision-making based on pipeline potential, not guesswork.

Data Events And Customer Behavior

In this context, data events are the signals tied to attendee presence, not clicks.

Examples:

- Account presence → target companies attending

- Senior role density → executives onsite who matter

- Sponsor lists → competitive insights

- Booth exhibitors → category trends

- Net-new ICP accounts → expansion opportunities

- Predicted attendance → historical presence signals

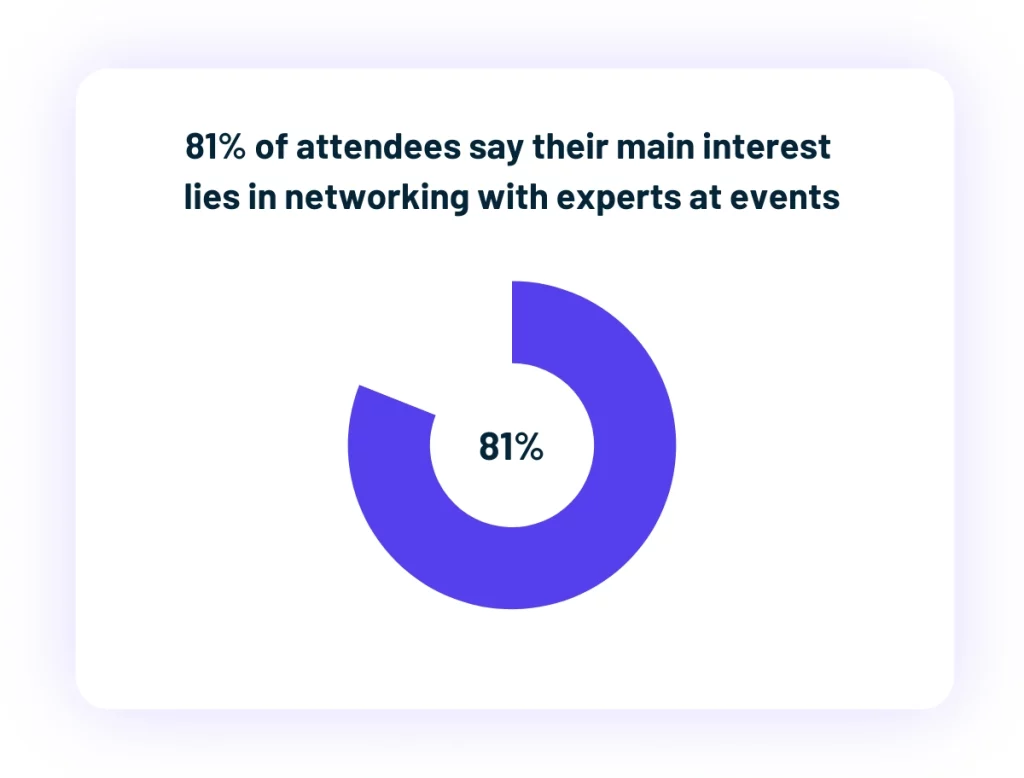

81% of attendees say their main interest is networking with experts.

Your job as a B2B event marketer is to use these signals to create qualified meetings, not to analyze microsite click paths.

Measuring Event Success: Track What Matters

Define success around meetings and revenue, supported by account-level intelligence.

Core KPIs

- ICP match rate

- Meetings requested / accepted / held

- Meeting-to-opportunity conversion

- Opportunity value

- Win rate

- Event-sourced & event-touched revenue

Supporting KPIs

- Registration (if hosting)

- Attendance

- Session engagement (if hosting)

- No-show rate

- Multi-event performance trends

Benchmarks

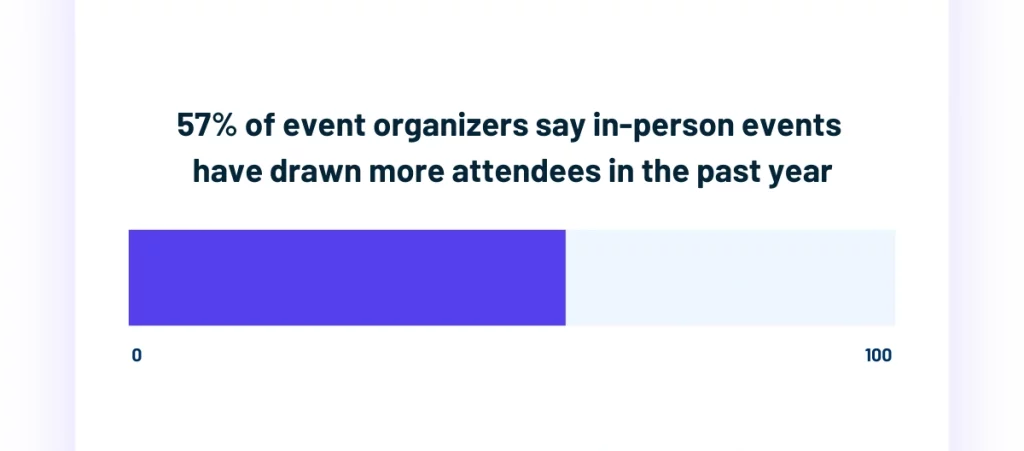

57% of event organizers say in-person events have drawn more attendees in the past year.

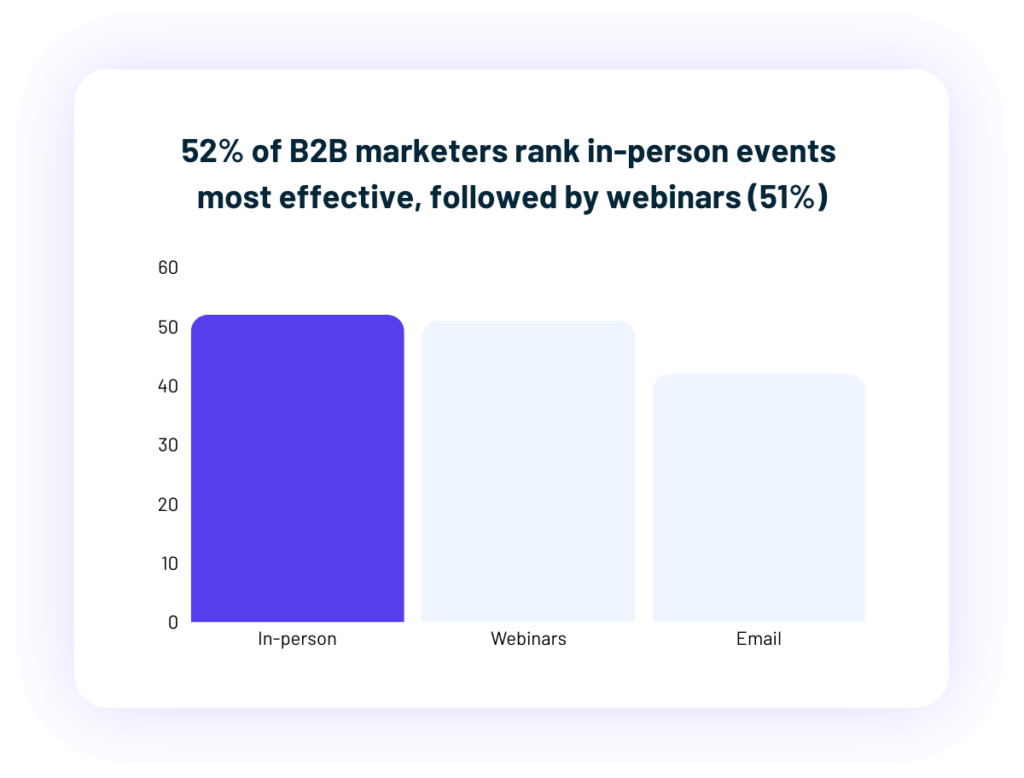

52% of B2B marketers say in-person events are their most effective distribution channel.

These benchmarks help justify spend and defend budget.

From Insight To Action: Improve Engagement And Pipeline

Event data is only valuable when it turns into execution.

Examples

- Low ICP presence? → deprioritize the event next year.

- High executive-level attendance? → run more top-tier dinner activations.

- Target accounts not booking meetings? → personalize outreach by role and vertical.

- Competitors heavily sponsoring? → shift investment or refine messaging.

Vendelux removes friction by turning insights into action:

- automated meeting booking

- CRM sync

- cross-event reporting

- pipeline attribution

Overcoming Common Data Challenges

Privacy

Handle attendee lists with consent and proper governance.

Integration

Unify CRM, marketing automation, and event intelligence into one workflow (Vendelux → HubSpot/Salesforce).

Scale

As your event program grows, structured data becomes non-negotiable.

How Vendelux Operationalizes Audience Intelligence

- Confirmed attendee data: real buyers, not guesses

- Predicted attendance: machine learning from historical data

- Sponsor intelligence: understand who is investing and why

- Meetings automation: 3.5% positive reply rate vs 1.5% industry

- Meeting rate: 2.3% vs 0.4% industry

- CRM integration: Salesforce & HubSpot, event-sourced + touched revenue in Q4 2025

Case Study Snapshots

Voltage

- 300% YoY increase in late-stage pipeline

- 6x more qualified meetings per event

- ROI in under 100 days

- Largest deal in company history came from an event they would have skipped

Delivery Solutions

- 76 incremental, targeted meetings at Shoptalk

- Personalized outreach lifted reply rates and meeting quality

- Stronger ROI through precise ICP targeting

Book A Demo

Ready to turn event data into meetings, pipeline, and revenue? Book a demo and see how Vendelux powers a meetings-first program across executive dinners, side activations, roadshows, conferences, demo days, and user conferences.

Frequently Asked Questions

1) Which event data should I track if I care about meetings and revenue?

Confirmed attendees, predicted attendees, sponsors, exhibitors, ICP presence, account match rate, and meeting outcomes.

2) How do I turn audience intelligence into booked meetings?

Use confirmed attendee lists, segment by account and role, personalize messaging, and start outreach early. Vendelux automates this for you.

3) What KPIs prove event success to leadership and finance?

Meeting rate, meeting → opp conversion, pipeline value, win rate, and event-sourced/touched revenue.

4) How does Vendelux integrate with our CRM?

Sync Salesforce or HubSpot, follow contacts and accounts, push lists into sequences, and attribute revenue to events.

5) How do insights improve future events?

Analyze ICP presence, meeting performance, segment trends, and competitor investments. Adjust event mix and outreach strategy accordingly.