You’re not asking for a trip. You are asking for an investment that converts into meetings, pipeline, and revenue.

Event justification is how you explain that clearly, with a justification letter that ties event attendance to company outcomes, shows event costs and savings, and proves why this year’s event is the right one for your business.

TLDR: Key Takeaways

- Event justification is about proving value, not asking for approval. Your justification letter must connect event attendance to meetings, pipeline, and revenue so event marketers earn a faster yes.

- Include specifics that Finance wants: event name, date, location, agenda highlights, thought leaders and industry leaders, and how sessions map to current projects.

- Show a clear cost picture, for example registration with early bird discounts, travel, accommodation, and options that demonstrate cost control.

- Translate benefits of attending into CFO metrics: meetings booked with potential clients, lead generation, and professional development tied to emerging technologies and industry trends.

- Commit to a post-event report with outcomes, attendee feedback, and next steps. Make it easy for Finance to see the business impact and why attending is the better idea.

Why event justification matters to Finance

Finance and the CFO want evidence that conference attendance influences revenue, partnerships, and professional growth. In-person events are consistently effective, with 52% of B2B marketers ranking them as their top channel for results, and webinars next at 51%.

That is why conference participation deserves to be framed as a pipeline driver, not a travel expense.

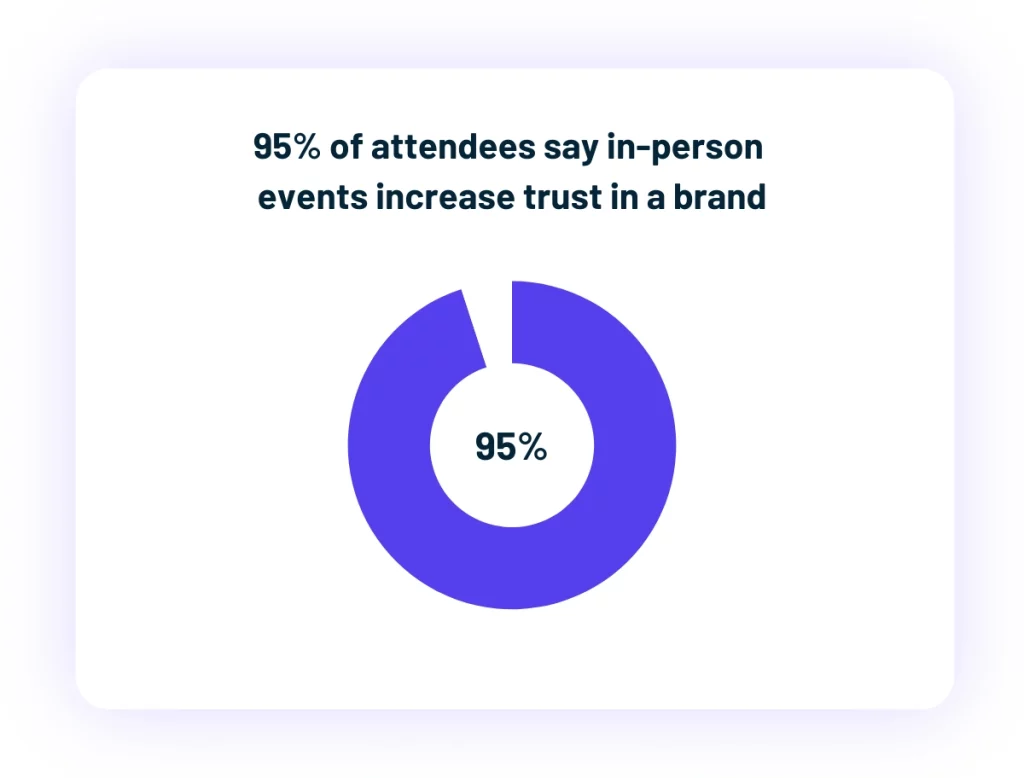

After attendees engage in person, 95% say their trust in a brand increases, which supports stronger relationships and repeat business.

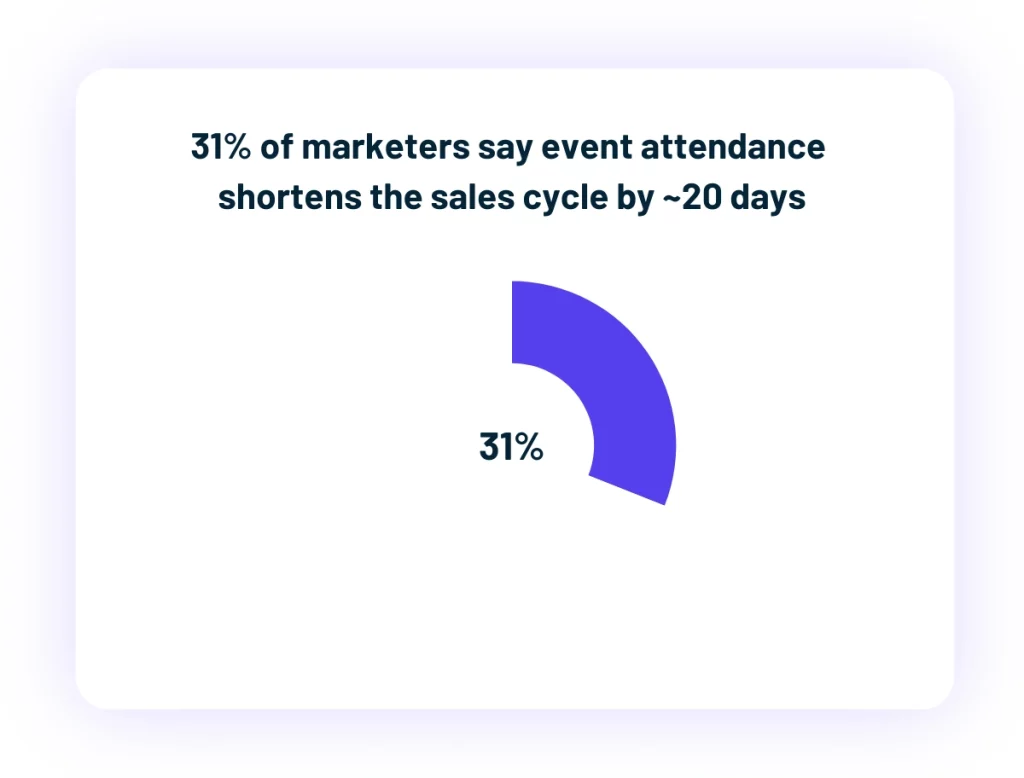

And when prospects attend events, 31% of marketers report the sales cycle shortens by about 20 days, a clear signal of pipeline acceleration.

Build a CFO-ready justification letter

Explain the business case in the CFO’s language. Keep the writing tight and use terms like investment, ROI, event profit potential, and risk mitigation.

Include specific event details

- Event name, date, and location.

- Agenda tracks and sessions that align to current projects, with the thought leaders or industry leaders you will learn from.

- Hands on training or workshops that build new skills, plus any cutting edge techniques or case studies on emerging technologies and practices.

- Past successes, such as partners you met at previous events or sessions that generated new ideas for the company.

Outline event costs and savings

- Registration fees with early bird discounts.

- Travel, accommodation, meals, and incidentals.

- Any additional sessions or networking functions tied to meeting potential clients.

- Alternatives that demonstrate cost control, for example comparable venues or lower-cost dates.

Translate benefits of attending into CFO metrics

Tie participation to measurable outcomes the company cares about:

- Meetings and pipeline. Use attendee insights to forecast meetings booked with target accounts and decision makers.

- Lead generation. Estimate leads generated from in-person networking, booth conversations, and scheduled meetings, then apply historical conversion rates.

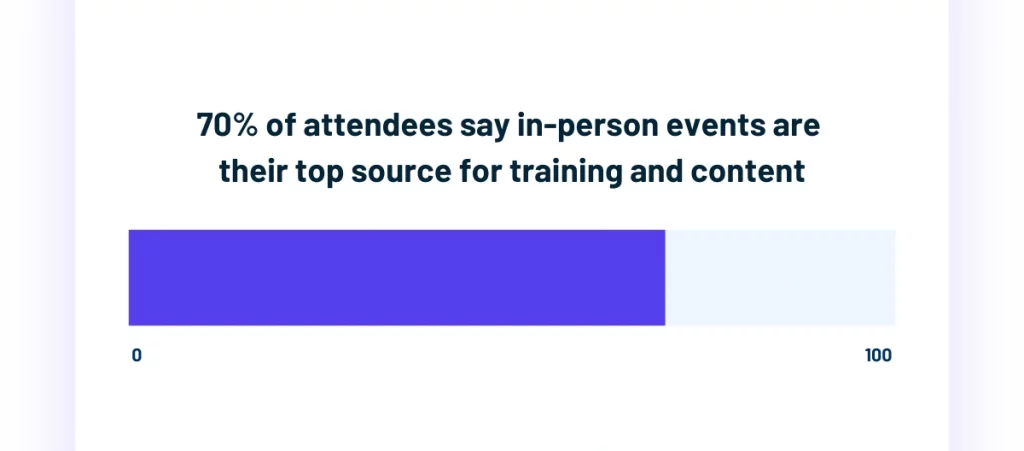

- Professional development. Specify which sessions build professional development and professional growth for employees, how the skills will be applied on current projects, and how knowledge will be shared with colleagues and peers. Seventy percent of attendees say in-person events are their best source of training and professional content, which makes this development benefit both credible and material.

- Strategic partnerships. Identify partners you plan to meet and how those partnerships could contribute to revenue or reduce costs.

Add proof with confirmed data, not guesswork

Vendelux shows which accounts and decision makers are already registered, so you can accurately measure event ROI before you commit. You identify your target audience, validate ICP density, and prioritize the sessions and networking blocks where potential clients will be.

Vendelux also books meetings for you using confirmed attendee data, then syncs outcomes to Salesforce or HubSpot for attribution. Teams using Vendelux see a 2.5x higher positive response rate, 3.5% vs 1.5%, and a 6x higher meeting rate, 2.3% vs 0.4%, than industry averages.

A simple justification letter structure you can copy

- Purpose: Explain why attending this conference aligns with company strategy and revenue goals.

- Event details: Event name, date, location, key sessions, relevant thought leaders, and how those sessions support current projects.

- Business value: Meetings you will target, potential clients to engage, partnerships to explore, and specific insights you expect to gain.

- Cost breakdown: Registration with early bird discounts, travel, accommodation, meals, and any additional event costs.

- Projected outcomes: Meetings forecast, leads generated, expected pipeline, and how you will create and share knowledge and new ideas with the team.

- Post-event plan: Timeline to deliver a report with outcomes, attendee feedback, session notes, and next steps for the organization.

Example numbers CFOs appreciate

- Meetings plan: 18 meetings with ICP accounts confirmed via Vendelux, aiming for 4 opportunities created.

- Pipeline math: 4 opportunities x average deal size of 120k = 480k pipeline; historic win rate of 25% implies 120k revenue potential.

- Cost vs return: Total event costs of 8,500, implying a strong investment-to-return ratio if expected outcomes are met.

- Skills plan: Two employees attend hands on training on emerging technologies and bring back a 60-minute internal session to upskill the team.

Post-event accountability that seals the case

Finance wants proof that the investment delivered value. Commit to:

- Reporting within 10 business days: meetings booked, leads generated, opportunities opened, and qualitative insights from sessions.

- Action plan: how new skills, practices, and insights will be applied to current projects and shared with the wider team.

- Attribution: meetings and opportunities logged in CRM with sources, so leadership can track the contribution of conference attendance to pipeline and success.

Why Vendelux is your advantage

With Vendelux, you evaluate conference attendance using confirmed attendee data, not estimates. You identify the right events, secure meetings in advance, and attribute outcomes in CRM. That is how you justify event attendance with confidence, connect participation to business value, and earn fast approval from Finance.

Book a demo to see how Vendelux helps you justify spend, book more meetings, and prove ROI.

FAQs

1) What should my justification letter include to win CFO approval?

Include event name, date, location, agenda highlights, expected meetings with target accounts, a clear event costs breakdown with early bird discounts, and projected outcomes, for example leads generated and pipeline created.

2) How do I quantify professional development in financial terms?

Link sessions and hands on training to current projects and expected improvements in cycle time, quality, or output. Commit to internal enablement so the skills scale beyond the attendee.

3) What metrics prove conference attendance delivered ROI?

Meetings booked, leads generated, opportunities opened, conversion rates, shortened sales cycle, and revenue attributed. Add attendee feedback and session notes for context.

4) How can I know if an event is worth it before I commit?

Use Vendelux to see confirmed attendee data and ICP density, then forecast meetings and pipeline. This lets you evaluate event ROI up front instead of guessing.

5) What should my post-event report to Finance include?

A summary of meetings, leads, and opportunities, the pipeline value created, costs vs projected ROI, attendee satisfaction highlights, and an action plan for applying insights.