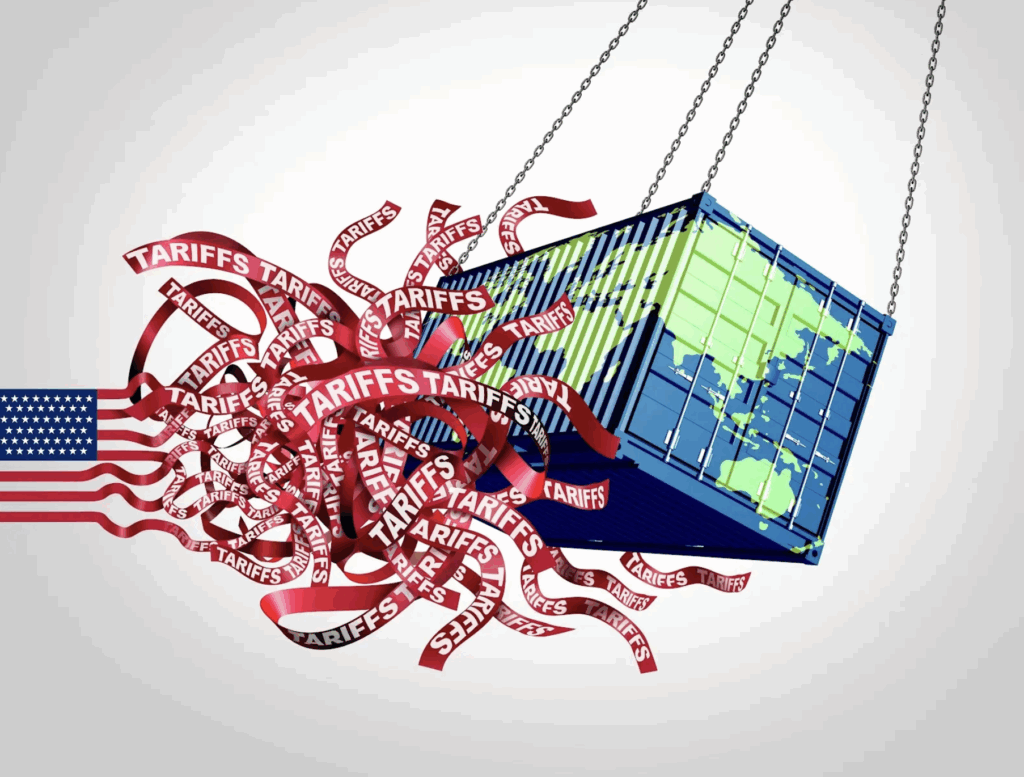

Tariffs on imported goods such as produce, electronics, vehicle parts and even movies threaten to disrupt the supply chain and raise prices across the board. While not all suggested taxes have gone into effect, the threat of them is already raising alarms and causing event organizers and brand marketers to make alternate plans.

At a minimum, increased costs for the likes of avocados and AV equipment figure to add to event budgets that are already strained. History—from 9/11 to the Great Recession and most recently, COVID-19—suggests that should the country slip into a recession, corporate travel will significantly decline.

US Travel Association statistics show that a combination of ill-will from potential foreign visitors, declining meeting attendance and economic concerns is negatively impacting travel

Whether any potential short-term pain is rewarded with greater future prosperity remains to be seen.

To gauge the tariff fallout, Vendelux gathered feedback from veteran event professionals and brand marketers to determine how attendees will be affected by the current trade winds…

“Tariffs are affecting attendees directly—by raising the price of participation while shrinking the experience they receive in return. At the property level, our Avendra Flash procurement reports have shown sustained month-over-month increases since January and are forecast to continue to increase: Coffee prices are up over 25%, eggs have spiked between 20-29% and proteins like chicken, pork, and beef are all experiencing double-digit inflation. Produce, baked goods and seafood are now categorized as ‘tight supply,’ meaning even when you can source it, it may not arrive on time or at all. All of this means that when we plan and deliver a daily menu, we’re having to reduce offerings, adjust menus or cut meals altogether to help meet budgets.

The attendee feedback in internal post-event surveys and public reviews we’ve seen over the last three months is literally the writing on the wall. Attendees are noticing when the coffee runs out before the first break ends, when a plated lunch is swapped for a boxed sandwich or when food and beverage upgrades that used to be included now come with an extra fee. These cuts might look small on paper, but they’re adding up to a real perception shift in value.

And then there’s labor. Tariffs increase operational costs across the board, but they’re also tightening the labor market in cities where events take place. Hotels and venues are already struggling to staff up due to housing costs and limited workforce pipelines—and no one in service can work remotely. One F&B manager I know is on week six of six-day stretches, averaging 12-14 hours daily, simply because there’s no one to take the load off. For attendees, that is showing up as slower service, longer lines and fewer high-touch moments.” —Lindsay Martin-Bilbrey, F&B culinary manager, Hyatt, and third-party event producer, Nifty Method

“Our B2B manufacturing clients are full steam ahead even with these tariffs in place. One client just got back from an international tradeshow in Germany. Many of our manufacturing clients are primarily American made, which is significantly helping them against competitors who source a lot of parts and pieces from outside of the United States. While this is a temporary unstable economic time, our clients are playing the long game given they still have to move and sell product. We are working on activating many upper funnel campaigns over the next three months from an overall branding standpoint while pairing this with lower funnel conversions as well. Our clients say this and we agree: Our nation is resilient and even with this setback, we always figure out a way to make it through the hardest of situations.” —Sam Littlefield, President & CEO, Littlefield Agency

“Potential tariffs can significantly impact event logistics and attendee participation. Increased costs for travel, shipping of event materials, food and beverage and other logistics directly influence the overall event budget. As a result, organizers may be forced to raise registration fees to offset these expenses. For international attendees, tariffs can also be part of broader trade tensions that lead to visa challenges or delays. Currency fluctuations driven by tariff-related instability can make international travel and accommodations less affordable, ultimately discouraging participation.” —Mary Adams, Founder & CEO, Avivant Partners

“It seems like there’s a bit of a holding pattern until we truly understand how this will affect prices, budgets and supply chains. A new status quo has to be established before the events industry will truly feel comfortable again. In the meantime, event professionals are working to understand the immediate cost changes (i.e. food, swag, floral) and the slower increase changes (i.e. AV production, booth materials, travel). These slower increase items will be noticed when new gear and materials need to be purchased and therefore a higher rental rate for clients may need to be introduced to cover the higher cost.

So what exactly does this mean for events? Attendees will most likely attend less events over the course of the year, so they will seek out high-value and -impact events. As event professionals, collaboration will be key in creating these events. We must use our creativity to the fullest to create the highest impact with given budgets and gear.” —President of a leading AV company who spoke to Vendelux on condition of anonymity

“Discussions around tariffs and their potential impact on our industry can be overwhelming, but we believe we need to have some data before reacting. From the pandemic we learned that there are various proactive steps that event teams can be taking, and that a great place to start is ‘triaging’ your program. Identify what decisions you need to make now, where you are fully committed, where you need to spend money, etc., versus what can wait. Once you’ve determined that, you should start open and transparent conversations with partners, vendors and suppliers. Discuss any cost impact to your program, and how costs may be shared with them, versus costs being passed to you. Recent research from multiple groups suggests that 2025 budgets in many sectors are on par with the 10-plus-year historical average. Let’s think about how we can get smarter with those budgets to prepare for any uncertain times ahead.” —Brad Gillespie, Founder, The METHOD Project